Washington, D.C. 20549

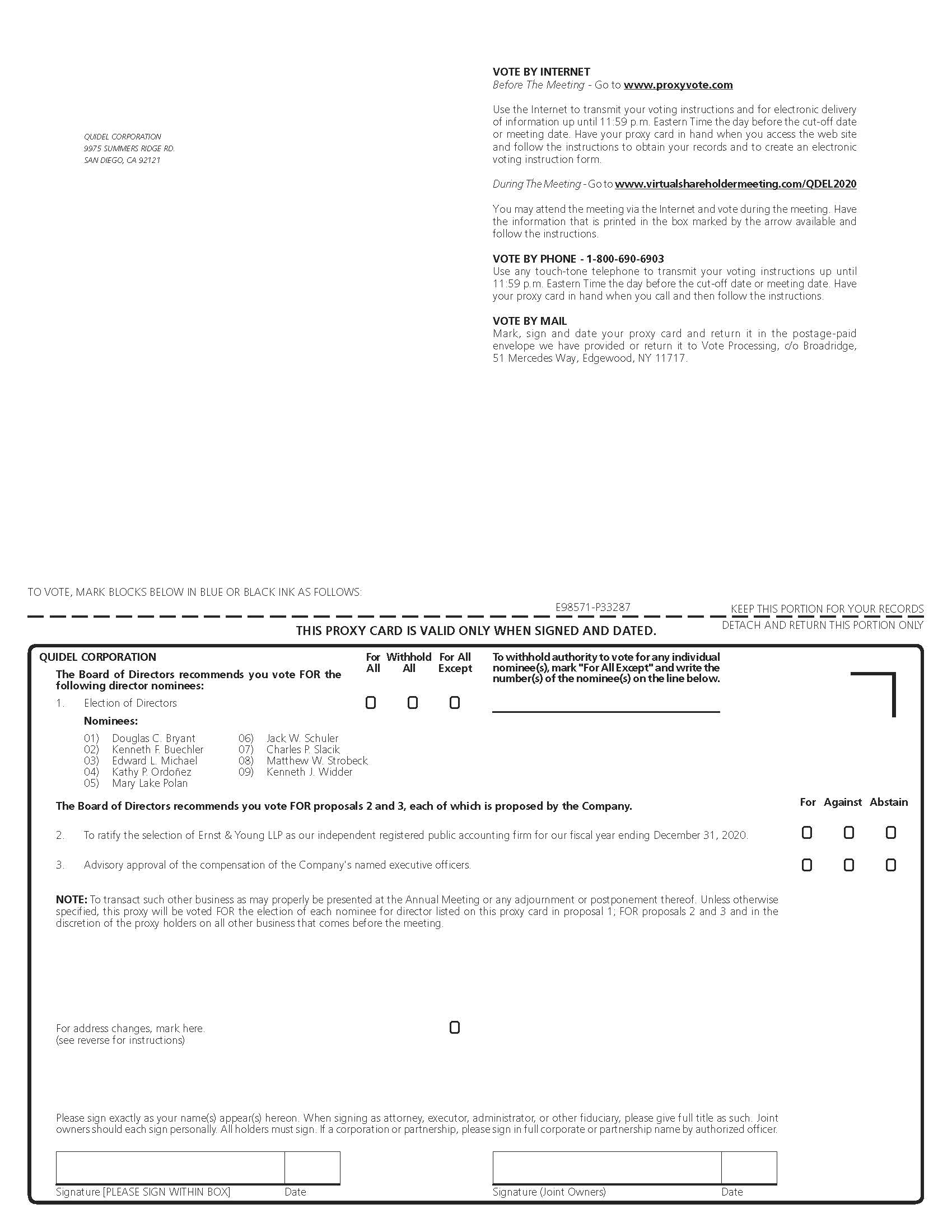

At the Annual Meeting, you will be asked to consider and vote upon: (i) the election of the sevennine directors designated herein to the Board of Directors; (ii) the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2016;2020; (iii) advisory approval of the Company’s executive compensation; (iv) the approval of the adoption of our 2016 Equity Incentive Plan; (v) an amendment and restatement of our 1983 Employee Stock Purchase Plan; and (vi)(iv) such other business as may properly be presented at the Annual Meeting or any adjournments or postponements thereof.

QUIDEL CORPORATION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 17, 201612, 2020

To Our Stockholders:

The Annual Meeting of Stockholders of Quidel Corporation will be held on Tuesday, May 17, 2016,12, 2020, at 8:30 a.m., local time,Pacific Time. The Annual Meeting will be held virtually and can be accessed online at the Hilton La Jolla Torrey Pines, 10950 North Torrey Pines Road, La Jolla, California 92037,www.virtualshareholdermeeting.com/QDEL2020, for the following purposes:

1. To elect the sevennine directors designated herein to serve on the Board of Directors to hold office until the 20172021 Annual Meeting of Stockholders and until their successors are elected and qualified;

2. To ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2016;2020;

3. To obtain advisory approval of the Company’s executive compensation; and

4. To approve the adoption of the Quidel Corporation 2016 Equity Incentive Plan;

5. To approve the amendment and restatement of the Quidel Corporation 1983 Employee Stock Purchase Plan; and

6. To transact such other business as may properly be presented at the Annual Meeting or any adjournments or postponements thereof.

Only stockholders of record at the close of business on March 23, 201618, 2020 are entitled to receive notice of and to vote atduring the Annual Meeting and any adjournments or postponements thereof.

The Board of Directors of Quidel Corporation unanimously recommends that the stockholders vote FOR the sevennine nominees for the Board of Directors named in the accompanying Proxy Statement; FOR the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm; and FOR the advisory approval of the Company’s executive compensation; FOR the adoption of the 2016 Equity Incentive Plan; and FOR the amendment and restatement of the 1983 Employee Stock Purchase Plan.compensation.

All stockholders are cordially invited to attend the Annual Meeting.Meeting virtually. It is important that your shares be represented and voted at the Annual Meeting whether or not you plan to attend the Annual Meeting. You may vote your shares via the Internet, by telephone or by completing and returning a proxy card. If you attend the Annual Meeting virtually and wish to do so, you may vote your shares in personduring the meeting even if you have signed and returned your proxy card. Specific voting instructions are set forth in the accompanying Proxy Statement and on the proxy card.

|

| |

|

| By Order of the Board of Directors, |

|

| Douglas C. Bryant |

| President and Chief Executive Officer |

| QUIDEL CORPORATION |

San Diego, California

April 14, 20169, 2020

|

| | | | |

| | Page |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| * Indicates matters to be voted on at the Annual Meeting. | |

SUMMARY PROXY INFORMATION

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should review this entire Proxy Statement, as well as our Annual Report on Form 10-K for the fiscal year ended 2019.

ANNUAL MEETING

| | | | | | | | | | | | | | |

| Time and date: | 8:30 a.m. (Local Time), May 12, 2020 | | Record date: | March 18, 2020 |

| | | | |

| Place: | Via the Internet at virtualshareholdermeeting.com/QDEL2020 | | Voting: | Stockholders as of record date

are entitled to vote

|

| | | | |

| | | | |

PROPOSALSAND VOTING RECOMMENDATIONS

| | | | | | | | |

| Proposal | Board Recommendation | Page Reference |

Proposal No. 1 - Election of Nine (9) Directors | FOR All Nominees | |

| FOR | |

Proposal No. 3 - Advisory (Non-Binding) Vote on Executive Compensation | FOR | |

| | | | | |

DIRECTOR NOMINEES | Incumbent director nominees received an average vote of nearly 95.0% of votes cast in 2019 annual meeting of stockholders |

We are seeking your vote FOR all of the Audit Committeedirector nominees below: | |

| | | | | | | | | | | |

| Name | Age | Director Since | Principal Occupation |

| Douglas C. Bryant | 62 | | 2009 | President and Chief Executive Officer, Quidel Corporation |

| Kenneth F. Buechler, Ph.D., Chair | 66 | | 2007 | Founder and former President and Chief Scientific Officer of Biosite, Inc. |

| Edward L. Michael | 63 | | 2018 | Managing Partner and Co-Founder of LionBird Ventures |

| Kathy P. Ordoñez | 69 | | 2019 | Former CEO of RainDance Technologies, Inc., Celera Corporation, and Roche Molecular Systems, Inc. |

| Mary Lake Polan, M.D, Ph.D., M.P.H. | 76 | | 1993 | Clinical Professor of Obstetrics, Gynecology and Reproductive Sciences, Yale University School of Medicine |

| Jack W. Schuler | 79 | | 2006 | Co-founder, Crabtree Partners, LLC, a private investment company |

| Charles P. Slacik | 66 | | 2015 | Former Senior Vice President and Chief Financial Officer of Beckman Coulter Inc. |

| Matthew W. Strobeck, Ph.D. | 47 | | 2018 | Managing Partner of Birchview Capital |

| Kenneth J. Widder, M.D. | 67 | | 2014 | Chief Executive Officer, Sydnexis Inc. |

CORPORATE GOVERNANCE HIGHLIGHTS

| | | | | | | | |

| BOARD COMPOSITION | | BOARD ACCOUNTABILITY |

üAll independent directors, except for CEO director | | üAnnual election of the Board of Directors | |

| | 47üAnnual Board and committee evaluations |

| | üRegularly-held executive sessions of Audit and Permissible Non-audit Servicesnon- | |

| | 48üRobust executive and director equity ownership guidelines |

| | 48üIndependent Board approval of CEO compensation |

| | |

| | |

| STOCKHOLDER INTERESTS | | RISK OVERSIGHT |

üActive stockholder engagement practices | | üComprehensive risk oversight by the Board and Approval of Related Party Transactions | 48individual committees as well as management |

| | 48üRisk management principles implemented in management processes and in employee reporting responsibilities |

| | 48ü Commitment to sustainability and ethically and socially just practices and policies |

| | 49üRobust risk reporting system which provides timely and comprehensive information to the Board |

| |

| |

| |

AUDITOR MATTERS

As a matter of good corporate practice, we are seeking your ratification of Ernst & Young LLP as our independent registered public accounting firm for the 2020 fiscal year.

EXECUTIVE COMPENSATION

Consistent with our Board’s recommendation and our stockholders’ prior indicated preference, we propose an advisory vote to approve our executive compensation annually. Accordingly, we are seeking your approval, on an advisory basis, of the compensation of our Named Executive Officers, as further described in the “Compensation Discussion and Analysis” section of this Proxy Statement.

For a summary of our executive compensation and 2019 performance highlights, please refer to the “ExecutiveCompensation” section of this Proxy Statement on page 15.

QUIDEL CORPORATION

Principal Executive Offices

12544 High Bluff Drive, Suite 2009975 Summers Ridge Rd.

San Diego, California 9213092121

(858) 552-1100

ANNUAL MEETING OF STOCKHOLDERS

May 17, 201612, 2020

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Quidel Corporation for use at the 20162020 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Tuesday, May 17, 2016,12, 2020, at 8:30 a.m., local time,Pacific Time. The Annual Meeting will be held virtually and can be accessed online at the Hilton La Jolla Torrey Pines, 10950 North Torrey Pines Road, La Jolla, California 92037,www.virtualshareholdermeeting.com/QDEL2020 and at any and all adjournments and postponements of the Annual Meeting. This Proxy Statement and the accompanying proxy card will first be sent to stockholders on or about April 14, 2016.9, 2020.

We will pay the expenses in connection with this solicitation. Our employees may solicit proxies by mail, in person, by telephone, facsimile or other electronic means and will not receive any additional compensation for such solicitations. In addition, we have engaged InvestorCom, Inc. to aid in the solicitation of proxies to be voted at the Annual Meeting at an estimated cost of $10,000 plus out-of-pocket expenses. We will also pay brokers or other nominees for the expenses of forwarding soliciting material to beneficial owners.

RECORD DATE AND VOTING

The close of business on March 23, 201618, 2020 has been fixed as the record date (the “Record Date”) for determining the stockholders entitled to notice of and to vote at the Annual Meeting. On the Record Date, 32,319,58741,995,460 shares of our voting common stock were outstanding. Each share of such common stock is entitled to one vote on any matter that may be presented for consideration and action by the stockholders at the Annual Meeting. A quorum is required to transact business at the Annual Meeting. The holders of a majority of the outstanding shares of common stock on the Record Date and entitled to be voted at the Annual Meeting, present in person or by proxy, will constitute a quorum for the transaction of business at the Annual Meeting and any adjournments and postponements thereof. Abstentions and broker non-votes are counted for the purpose of determining the presence or absence of a quorum for the transaction of business.

Where a stockholder has directed how his or her proxy is to be voted, it will be voted according to the stockholder’s directions. If your shares are held in a brokerage account or by another nominee, you are considered the “beneficial owner” of shares held in “street name,” and this proxy and the related materials are being forwarded to you by your broker or nominee (the “record holder”) along with a voting instruction card. As the beneficial owner, you have the right to direct yourthe record holder of your shares regarding how to vote your shares, and the record holder is required to vote your shares in accordance with your instructions. If a proposal is routine, a broker or other entityrecord holder holding shares for a beneficial owner in street name may vote on the proposal without voting instructions from the owner.owner if the beneficial owner does not provide instructions. If a proposal is non-routine, the broker or other entity may vote on the proposal only if the beneficial owner has provided voting instructions. A “broker non-vote” occurs when the broker or other entityrecord holder is unable to vote on a proposal because the proposal is non-routine and the beneficial owner does not provide instructions.

If you do not give voting instructions to yourthe record holder of your shares prior to the Annual Meeting, the record holder will be entitled to vote your shares in its discretion only on Proposal 2 (Ratification of Selection of Independent Registered Public Accounting Firm) and will not be able to vote your shares on Proposal 1 (Election of Directors), or Proposal 3 (Advisory Approval of the Company’s Executive Compensation), Proposal 4 (Adoption of the 2016 Equity Incentive Plan) or Proposal 5 (Amendment and Restatement of the 1983 Employee Stock Purchase Plan), and your shares will be treated as a “broker non-vote” on those proposals. We are not aware of any other matters to be presented at the Annual Meeting except for those described in this Proxy Statement. However, if any other matters not described in this Proxy Statement are properly presented at the Annual Meeting, the persons named as proxies will use their own judgment to determine how to vote your shares. If the Annual Meeting is adjourned, your shares may be voted by the persons named as proxies on the new meeting date as well, unless you have revoked your proxy instructions prior to that time.

With regard to the election of directors, votes may be cast in favor of a director nominee or withheld. Because directors are elected by plurality, broker non-votes will have no effect on its outcome.the outcome of this proposal. If a quorum is present at the Annual Meeting, the nine nominees receiving the greatest number of votes (up to seven directors) will be elected. For Proposal 2 (Ratification of Selection of Independent Registered Public Accounting Firm), and Proposal 3 (Advisory Approval of the Company’s Executive Compensation), Proposal 4 (Adoption of the 2016 Equity Incentive Plan) and Proposal 5 (Amendment and Restatement of the 1983 Employee Stock Purchase Plan), the affirmative vote of a majority of the shares present in person or represented by proxy

at the Annual Meeting and entitled to vote on the matter is required for approval. With regard to these proposals,Proposals 2 and 3, abstentions will be counted in the tabulations of the votes cast on a proposal presented to stockholders and will have the same effect as a vote against thesuch proposal, whereas broker non-votes will not be counted for purposes of determining whether a proposal has been approved and accordingly will have no effect on the outcome of the vote on suchProposal 3. Because Proposal 2 (Ratification of Independent Registered Public Accounting Firm) is a routine

matter, no broker non-votes are expected with respect to this proposal. Unless otherwise designated, each signed proxy submitted by a stockholder will be voted:

•FOR each of the sevennine nominees named below for election as directors;

•FOR ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2016;2020; and

•FOR the advisory approval of the Company’s executive compensation;

FOR the adoption of the 2016 Equity Incentive Plan; and

FOR the amendment and restatement of the 1983 Employee Stock Purchase Plan.compensation.

Shares may be voted via the Internet, by telephone or by completing and returning a proxy card.Anycard. Any stockholder has the power to revoke his or her proxy at any time before it is voted at the Annual Meeting by submitting a written notice of revocation to the Secretary of the Company or by timely filing a duly executed proxy bearing a later date. The proxy will not be voted if the stockholder who executed it is present atattends the Annual Meeting virtually and elects to vote in person the shares represented by the proxy. AttendanceAttending at the Annual Meeting virtually will not by itself revoke a proxy.

To attend and participate in the Annual Meeting, you will need the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. If your shares are held in “street name,” you should contact your broker to obtain your 16-digit control number or otherwise vote through your broker. Only stockholders with a valid 16-digit control number, will be able to attend the Annual Meeting and vote, ask questions and access the list of stockholders as of the close of business on the Record Date for the Annual Meeting. Questions pertinent to Annual Meeting matters will be answered during the Annual Meeting, subject to time constraints. Questions regarding personal matters, suggestions for product development, or other matters unrelated to the proposals and Annual Meeting matters, are not pertinent to Annual Meeting and therefore will not be answered.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

PROPOSAL 1

ELECTION OF DIRECTORS

Nominees for Election

Our directors are elected at each annual meeting of stockholders. At the Annual Meeting, sevennine directors will be elected to serve until the next annual meeting of stockholders and until their successors are elected and qualified. The nine nominees receiving the greatest number of votes (up to seven directors) at the Annual Meeting will be elected.Our Board of Directors recommends that the stockholders vote FOR the seven nominees named below for election to the Board of Directors.

Rod F. Dammeyer, 75, has informed the Board that he intends to retire from the Board upon the conclusion of his current term and, therefore, will not stand for reelection at the Annual Meeting.

Each of the nominees set forth below for election as a director is an incumbent director. Kathy P. Ordoñez, who was recommended by a non-management director, other than Mr. Slacik who was appointed to the Board in November 2015 after being recommended for the Board by a non-employee director.effective June 20, 2019. Each of the nominees has consented to serve as a director if elected. Unless authority to vote for any director nominee is withheld in a proxy, it is intended that each proxy will be voted FOR each of the nominees. If, before the Annual Meeting, any of the nominees for director should become unable to serve if elected, it is intended that shares represented by proxies will be voted for such substitute nominees, if any, as may be recommended by our existing Board, of Directors, unless other directions are given in the proxies.

| | | | | | | | | | | | | | | | | | | | |

| Name of Nominee | | Age | | Principal Occupation | | Director

Since |

| Douglas C. Bryant | | 62 | | | President and Chief Executive Officer, Quidel Corporation | | 2009 |

| Kenneth F. Buechler, Ph.D., Chair | | 66 | | | Founder and former President and Chief Scientific Officer of Biosite, Inc. | | 2007 |

| Edward L. Michael | | 63 | | | Managing Partner and Co-Founder of LionBird Ventures | | 2018 |

| Kathy P. Ordoñez | | 69 | | | Former CEO of RainDance Technologies, Inc., Celera Corporation, and Roche Molecular Systems, Inc. | | 2019 |

| Mary Lake Polan, M.D., Ph.D., M.P.H. | | 76 | | | Clinical Professor of Obstetrics, Gynecology and Reproductive Sciences, Yale University School of Medicine | | 1993 |

| Jack W. Schuler | | 79 | | | Co-founder, Crabtree Partners, LLC, a private investment company | | 2006 |

| Charles P. Slacik | | 66 | | | Former Senior Vice President and Chief Financial Officer of Beckman Coulter Inc. | | 2015 |

| Matthew W. Strobeck, Ph.D. | | 47 | | | Managing Partner of Birchview Capital | | 2018 |

| Kenneth J. Widder, M.D. | | 67 | | | Chief Executive Officer, Sydnexis Inc. | | 2014 |

|

| | | | | | |

| Name of Nominee | | Age | | Principal Occupation | | Director Since |

| Thomas D. Brown | | 68 | | Retired Senior Vice President and President of the Diagnostics Division of Abbott Laboratories | | 2004 |

| Douglas C. Bryant | | 58 | | President and Chief Executive Officer, Quidel Corporation | | 2009 |

| Kenneth F. Buechler, Ph.D. | | 62 | | Founder and former President and Chief Scientific Officer of Biosite, Inc. | | 2007 |

| Mary Lake Polan, M.D., Ph.D., M.P.H. | | 72 | | Clinical Professor of Obstetrics, Gynecology and Reproductive Sciences, Yale University School of Medicine | | 1993 |

| Jack W. Schuler | | 75 | | Co-founder, Crabtree Partners, LLC, a private investment company | | 2006 |

| Charles P. Slacik | | 62 | | Former Senior Vice President and Chief Financial Officer for Beckman Coulter Inc. | | 2015 |

| Kenneth J. Widder, M.D. | | 63 | | General Partner, LVP Life Science Ventures | | 2014 |

Biographical Information

THOMAS D. BROWN was appointed to our Board of Directors in December 2004. Prior to his retirement in 2002, Mr. Brown had a 28-year career in the healthcare industry where he held various sales, marketing and executive positions within Abbott Laboratories, a broad-based healthcare company. From 1998 to 2002, Mr. Brown was Senior Vice President and President of the Diagnostics Division. From 1993 to 1998, Mr. Brown was Corporate Vice President Worldwide Commercial Operations. From 1992 to 1993, Mr. Brown was Divisional Vice President Worldwide Commercial Operations. From 1987 to 1992, Mr. Brown was Divisional Vice President and General Manager, Western Hemisphere Commercial Operations. From 1986 to 1987, Mr. Brown was Divisional Vice President U.S. Sales and, from 1985 to 1986, was Director of Sales. Mr. Brown currently serves on the Board of Directors of Cepheid, a molecular diagnostics company, and Stericycle, Inc., a medical waste management and healthcare compliance services company. Mr. Brown holds a B.A. degree from the State University of New York at Buffalo.

DOUGLAS C. BRYANT was appointed to our Board of Directors on February 2, 2009 and became our President and Chief Executive Officer on March 1, 2009. Prior to joining us, Mr. Bryant served as Executive Vice President and Chief Operating Officer at Luminex Corporation, managing its Bioscience Group, Luminex Molecular Diagnostics (Toronto), manufacturing, R&D, technical operations and commercial operations. From 1983 to 2007, Mr. Bryant held various worldwide commercial operations positions with Abbott Laboratories including, among others: Vice President of Abbott Vascular for Asia/

Japan, Vice President of Abbott Molecular Global Commercial Operations and Vice President of Abbott Diagnostics Global Commercial Operations. Earlier in his career with Abbott, Mr. Bryant was Vice President of Diagnostic Operations in Europe, the Middle East and Africa and Vice President of Diagnostic Operations Asia Pacific. Mr. Bryant has over 30 years of industry experience in sales and marketing, product development, manufacturing and service and support in both the diagnostics and life sciences markets. Mr. Bryant holds a B.A. in Economics from the University of California at Davis.

KENNETH F. BUECHLER, Ph.D. was appointed to our Board of Directors in November 2007. Dr. Buechler was President, Chief Scientific Officer and co-founder of Biosite Incorporated. From 1988 to 1994, Dr. Buechler was Biosite’s Director of Chemistry. Prior to co-founding Biosite, Dr. Buechler was a senior research scientist for the diagnostics research and development group at Hybritech Incorporated. Dr. Buechler received his Ph.D. in biochemistry and his bachelor’s degree in chemistry from Indiana University. Dr. Buechler also is a director of Sequenom Inc., a life sciences company, Sotera Wireless Inc., a technology solutions company, Astute Medical Inc., a company that develops biomarkers for acute medical conditions, and Edico Genome Inc., a DNA sequencing technology company.

MARY LAKE POLAN, M.D., Ph.D., M.P.H. was appointed to our Board of Directors in February 1993. She is a Professor and Chair Emerita of the Department of Gynecology and Obstetrics at Stanford University School of Medicine where she served from 1990 to 2005. Dr. Polan received a B.A. degree from Connecticut College, a Ph.D. in Molecular Biophysics and Biochemistry and an M.D. from Yale University School of Medicine and her Masters in Public Health from the University of California, Berkeley. Dr. Polan remained at Yale New Haven Hospital for her residency in Obstetrics and Gynecology, followed by a Reproductive Endocrine Fellowship. Dr. Polan was on the faculty at Yale University until 1990, when she joined Stanford University. She was an Adjunct Professor in the Department of Obstetrics and Gynecology at Columbia University School of Medicine from 2007 to 2014 and then in 2015 rejoined the Department of Obstetrics and Gynecology at Yale University School of Medicine as Clinical Professor. Dr. Polan is a practicing clinical Reproductive Endocrinologist with a research interest in ovarian function and granulosa cell steroidogenesis. More recently, Dr. Polan’s interests have been in the interaction between the immune and endocrine systems: the role of monokines in reproductive events and gene expression in stress urinary incontinence as well as brain activation in human sexual function. Dr. Polan also served on the Board of Directors of Wyeth, a research-based global pharmaceutical and health care products company, until its acquisition in 2009.

JACK W. SCHULER was appointed to our Board of Directors in February 2006. Mr. Schuler has been on the Board of Directors of Stericycle, Inc., a medical waste management and healthcare compliance services company, since March 1989 and currently serves as Lead Director. Mr. Schuler also currently serves on the Board of Directors of Accelerate Diagnostics, Inc., a medical diagnostics company. Mr. Schuler is also a co-founder of Crabtree Partners, LLC, a Chicago-based venture capital firm which was formed in 1995. Prior to 1990, Mr. Schuler held various executive positions at Abbott Laboratories, a broad-based healthcare company, from December 1972 through August 1989, most recently serving as President and Chief Operating Officer. Mr. Schuler also recently served on the Board of Directors of Medtronic Inc. from 1990 through 2013 and Hansen Medical, Inc., a medical technology company, from 2013 until January 2016. Mr. Schuler holds a B.S. in Mechanical Engineering from Tufts University and an M.B.A. from Stanford University.

CHARLES P. SLACIK was appointed to our Board of Directors in November 2015. Mr. Slacik has more than 30 years of executive experience in the health care industry, serving most recently as the Senior Vice President and Chief Financial Officer for Beckman Coulter Inc. from October 2006 until June 2011 when Danaher Corp. bought Beckman Coulter. Mr. Slacik currently serves as a Member of the Board and Chair of the Audit Committee at Sequenom, Inc., a life sciences company. Mr. Slacik received his B.S. in Accounting and Finance from the University of Connecticut and is a certified public accountant.

KENNETH J. WIDDER, M.D. was appointed to our Board of Directors in November 2014. Dr. Widder has more than 30 years of experience working with biomedical companies and has been a General Partner with LVP Life Science Ventures, a venture capital company for biotechnology and medical device start-ups, since 2007. Dr. Widder is also a member of the Board of Directors of Evoke Pharma Inc., a pharmaceutical company, and Aptinyx Inc., a neuropharmaceutical company. He holds an M.D. from Northwestern University and trained in pathology at Duke University.

Vote Required and Board Recommendation

The nominees for election as directors will be elected by a plurality of the votes of the shares present in person or represented by proxy and entitled to vote on the proposal at the Annual Meeting.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE NAMED NOMINEES IN PROPOSAL 1.

PROPOSAL 2

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has selected the firm of Ernst & Young LLP, independent registered public accounting firm, to audit our consolidated financial statements for the fiscal year ending December 31, 2016 and to perform other appropriate accounting and tax services. We are asking our stockholders to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for 2016. Although ratification is not required by our bylaws or otherwise, the Board of Directors is submitting the selection of Ernst & Young LLP to our stockholders as a matter of good corporate practice. If the stockholders do not ratify the appointment of Ernst & Young LLP, the selection of the Company’s independent registered public accounting firm will be reconsidered by the Audit Committee. Even if the selection is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

One or more representatives of Ernst & Young LLP are expected to be at the Annual Meeting. The representatives of Ernst & Young LLP will have an opportunity to make a statement, if they so desire, and will be available to respond to appropriate questions.

Vote Required and Board Recommendation

The affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal is required to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for 2016.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF THE SELECTION OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2016.

PROPOSAL 3

ADVISORY APPROVAL OF THE COMPANY’S EXECUTIVE COMPENSATION

We are providing stockholders with an advisory (non-binding) vote on the compensation of our Named Executive Officers (commonly referred to as “say on pay”). Accordingly, you may vote on the following resolution at the Annual Meeting:

“Resolved, that the compensation paid to the Company’s Named Executive Officers, as disclosed in the “Compensation Discussion and Analysis,” the accompanying compensation tables, and the related narrative discussion in this Proxy Statement, is hereby approved.”

The advisory approval of the Company’s executive compensation is a non-binding vote on the compensation paid to the Company’s Named Executive Officers, as described pursuant to Item 402 of Regulation S-K, including the “Compensation Discussion and Analysis” section, compensation tables, and the narrative discussions, set forth in this Proxy Statement.

As described in detail under “Executive Compensation--Compensation Discussion and Analysis,” our compensation programs are designed to attract, motivate and retain highly qualified executive officers who are able to achieve corporate objectives and create stockholder value. The Compensation Committee believes the Company’s executive compensation programs reflect a strong pay-for-performance philosophy and are well aligned with our stockholders’ long-term interests. Stockholders are encouraged to read the “Compensation Discussion and Analysis” section, the accompanying compensation tables, and the related narrative discussion.

Because the vote on this proposal is advisory in nature, it will not affect any compensation already paid or awarded to our Named Executive Officers and will not be binding on the Board of Directors or the Compensation Committee. However, the Compensation Committee will consider the outcome of the vote when making future executive compensation decisions.

The affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal is required to approve the advisory vote on executive compensation.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS.

PROPOSAL 4

ADOPTION OF THE 2016 EQUITY INCENTIVE PLAN

General

At the Annual Meeting, the stockholders will be asked to approve the Quidel Corporation 2016 Equity Incentive Plan (the “2016 Plan”). The 2016 Plan was unanimously approved by the Board of Directors on February 23, 2016, subject to the approval of stockholders at the Annual Meeting. We continue to rely heavily upon equity compensation to recruit, retain, motivate and reward our employees, management, directors and other qualified persons, and to align their interests with the interests of our stockholders. By approving Proposal 4, stockholders will enable us to continue to use equity compensation for these purposes.

Our equity compensation program is currently operated under the Quidel Corporation 2010 Equity Incentive Plan, as amended (the “2010 Plan”). As of March 23, 2016, a total of 4,651,008 shares were authorized for issuance under the 2010 Plan, and only 665,650 shares remained available for future issuance. In addition, as of March 23, 2016, there were 4,515,948 stock options outstanding under the Company’s equity compensation plans with a weighted average exercise price of $17.16 and weighted average remaining term of 6.05 years. Further, as of March 23, 2016, there were 515,586 restricted stock unit awards outstanding under the Company’s equity compensation plans. Other than the foregoing, no other awards under the Company’s equity compensation plans were outstanding as of March 23, 2016. Upon approval of the 2016 Plan by stockholders, the 2016 Plan will supersede and replace the 2010 Plan and all other similar plans adopted by the Company at any time in the past (collectively, the “Prior Plans”), provided that all Prior Plans shall remain in effect until all awards granted under the Prior Plans have been exercised, forfeited, canceled, or have otherwise expired or terminated. No further awards will be made under the Prior Plans if and when the 2016 Plan is approved by stockholders.

Please refer to the Securities Available for Issuance Under Our Equity Compensation Plans table on Page 18 for information regarding our equity incentive plans.The potential dilution from the 1,865,000 “new” shares requested to be approved by stockholders is 5.77% of the Company’s outstanding shares of common stock as of March 23, 2016. The potential dilution from the 5,697,184 shares authorized for issuance under the 2010 Plan is 17.63% of the Company’s outstanding shares of common stock as of March 23, 2016. Therefore, if the 2016 Plan is approved, the Company’s total potential dilution would increase from 17.63% of the Company’s outstanding shares of common stock under the 2010 Plan as of March 23, 2016 to 23.40% of the Company’s outstanding shares of common stock under the 2016 Plan as of March 23, 2016.

The Company oversees its long-term dilution by managing the number of shares subject to equity awards that it grants annually, commonly referred to as the burn rate (calculated by dividing all shares subject to equity awards granted during the fiscal year by the number of outstanding shares at the end of the fiscal year). The burn rate shows how rapidly a company is depleting its shares reserved for future issuance under its equity compensation plans. Over the past three fiscal years, the Company’s burn rate has averaged 2.18% (2.43% in fiscal year 2015, 2.04% in fiscal year 2014 and 1.78% in fiscal year 2013) and the Company’s adjusted burn rate has averaged 2.66% (3.19% in fiscal year 2015, 2.67% in fiscal year 2014 and 2.11% in fiscal year 2013), while the industry group adjusted burn rate over the last three years averaged 5.14%. The Company’s adjusted burn rate and industry group burn rate data was provided by Institutional Shareholder Services Inc., commonly known as “ISS.” The adjusted burn rates incorporate an adjustment whereby full-value awards are multiplied by a burn rate multiplier that is based on stock option volatility; our full-value awards were subject to a 2.5 burn rate multiplier. We believe our significantly lower burn rate compared to our industry group’s burn rate over the last three years shows we have prudently managed our dilution in terms of burn rate.

When considering the number of shares to be approved under the 2016 Plan, the Compensation Committee also reviewed, among other things, projected future share usage and projected future forfeitures. The projected future usage of shares for long-term incentive awards under the 2016 Plan was reviewed under scenarios based on a variety of assumptions. Depending on assumptions, the 1,865,000 shares to be approved under the 2016 Plan, in combination with the remaining authorized shares and shares added back to the plan from forfeitures of awards previously granted, is expected to satisfy, assuming no significant acquisitions of other companies, the Company’s equity compensation needs for approximately two to three years. The Compensation Committee is committed to effectively managing the number of shares reserved for issuance under the 2016 Plan, in light of the 2016 Plan’s purposes, while minimizing stockholder dilution.

The 2016 Plan is intended to permit the award of equity compensation that may qualify as “performance-based compensation” within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended; however, there can be no guarantee that amounts payable under the 2016 Plan will be treated as qualified performance-based compensation under Section 162(m). The Board of Directors believes that it is in the best interests of our stockholders for us to have a stockholder-

approved plan under which equity compensation awarded to our executives could be designed in a manner intended to qualify as “performance-based compensation” within the meaning of Section 162(m). In general, under Section 162(m), in order for us to be able to deduct compensation in excess of $1,000,000 paid in any one year to our chief executive officer or any of our three other most highly compensated executive officers (other than our chief financial officer), such compensation must qualify as “performance-based.” One of the requirements of “performance-based” compensation for purposes of Section 162(m) is that the material terms of the performance goals under which compensation may be paid be disclosed to and approved by stockholders at least once every five years. For purposes of Section 162(m), the material terms include (i) the individuals eligible to receive compensation, (ii) a description of the criteria on which performance goals are based, and (iii) the maximum amount of compensation that can be paid to an individual under a performance goal. With respect to the various types of awards under the 2016 Plan, each of these aspects is discussed below, and stockholder approval of this Proposal 4 will be deemed to constitute approval of each of these aspects of the 2016 Plan for purposes of the stockholder approval requirements of Section 162(m).

Summary of the 2016 Plan

The following summary of the 2016 Plan, as proposed to be adopted, is qualified in its entirety by reference to the terms of the 2016 Plan, a copy of which, as proposed to be amended, is attached hereto as Appendix A.

Purpose. The purpose of the 2016 Plan is to promote our and our stockholders’ interests by using equity interests in the Company to attract, retain and motivate our directors, management, employees and other persons, to encourage and reward their contributions to our performance and to align their interests with the interests of our stockholders.

Administration, Amendment and Termination. The 2016 Plan is currently administered by the Compensation Committee of our Board of Directors (the “administrator”). The administrator has the power to:

select the eligible persons to whom, and the times at which, awards will be granted, the nature of each award and the terms and conditions of each award;

interpret the 2016 Plan and the rights of recipients of awards granted under the 2016 Plan;

accelerate or extend the vesting or exercise period of any award, and make such other modifications in the terms and conditions of an award as it deems advisable; provided, however, that the administrator may not, other than in connection with a change in capitalization, reprice or otherwise reduce the exercise or base price of a stock option or stock appreciation right (including by the cancellation of the stock option or stock appreciation right in exchange for cash, other awards, or a new stock option or stock appreciation right at such reduced exercise or base price or by amendment of the stock option or stock appreciation right) without stockholder approval; and

change the number of shares or vesting periods associated with non-employee director options, and suspend and reactivate the 2016 Plan provisions regarding automatic grants of non-employee director options.

Any amendment of the 2016 Plan shall, in the discretion of the administrator, apply to and govern awards granted under the 2016 Plan prior to the date of such amendment;provided, however, that the consent of an award holder is required if such amendment would alter, impair or diminish in any material respect any rights or obligations under any award or cause the award to cease to qualify as an incentive stock option. Awards may be granted under the 2016 Plan until May 17, 2026, unless earlier terminated.

Securities Subject to the 2016 Equity Incentive Plan. The aggregate number of shares of common stock issuable pursuant to the 2016 Plan may not exceed 1,865,000 shares, plus (i) any shares that were authorized for issuance under the 2010 Plan that, as of the date of the Annual Meeting, remain available for issuance under the 2010 Plan (not including any shares that are subject to outstanding awards under the 2010 Plan or any shares that previously were issued pursuant to awards granted under the 2010 Plan) and (ii) any shares subject to outstanding awards under the Company’s 2001 Equity Incentive Plan and 2010 Plan as of the date of the Annual Meeting that on or after such date cease for any reason to be subject to such awards (other than by reason of exercise or settlement of the awards to the extent they are exercised for or settled in vested and nonforfeitable shares), subject in each case to adjustment upon a change in capitalization.

As noted above, as of March 23, 2016, 665,650 shares remained available for issuance under future awards that could be granted under the 2010 Plan (which shares will cease to be available for issuance under the 2010 Plan upon stockholder approval of the 2016 Plan). As such, if the 2016 Plan is approved by stockholders, approximately 2,530,650 shares will initially be available for awards under the 2016 Plan consisting of 1,865,000 “new” shares and approximately 665,650 remaining shares previously authorized and available for issuance under the 2010 Plan.

The 2016 Plan provides that each share issued under awards other than options or stock appreciation rights (“full-value awards”) will count against the number of shares available under the Plan as 1.5 shares. Shares issued under options or stock

appreciation rights count against the shares available under the Plan on a one-for-one basis. The Board of Directors believes that this formula-based limit will allow for the issuance of a sufficient number of full-value awards to satisfy projected grants thereof, while providing the flexibility to change the mix of option and full-value awards to the extent the Board of Directors determines a different mix than currently provided is in the best interests of the Company and stockholders.

We may issue common stock under the 2016 Plan from authorized but unissued shares of common stock or from previously issued shares of common stock that we reacquired, including shares purchased on the open market. For purposes of calculating the aggregate number of shares issued under the 2016 Plan, we will count only the number of shares issued upon exercise or settlement of an award and not returned to us upon expiration, termination or cancellation of any awards. However, if an award holder pays the exercise price or withholding taxes relating to an option or stock appreciation right with shares of our common stock, or if we withhold shares otherwise issuable upon exercise of such an award in satisfaction of the exercise price or withholding taxes payment, then we will reduce the number of shares of common stock available for issuance under the 2016 Plan by the gross number of shares for which the award is exercised. In addition, upon the exercise of a stock appreciation right, the number of shares of common stock available for issuance under the 2016 Plan will be reduced by the gross number of shares to which the award relates and not by the net number of shares issued to the holder in settlement thereof.

The 2016 Plan provides that the administrator shall appropriately and proportionately adjust the maximum number and kind of shares subject to the 2016 Plan, the number and kind of shares or other securities subject to then outstanding awards, the price for each share or other unit of any other securities subject to, or measurement criteria applicable to, then outstanding awards, and/or the number and kind of shares or other securities to be issued as non-employee director options if our common stock is affected through any of the following:

merger;

consolidation;

sale or exchange of assets;

recapitalization;

reclassification;

combination;

stock dividend;

extraordinary cash dividend;

stock split;

reverse stock split;

spin off; or

similar transaction.

Awards Under the 2016 Plan. We may grant the following types of awards under the 2016 Plan:

stock options;

performance awards;

restricted stock;

stock appreciation rights;

stock payments;

dividend equivalents;

stock bonuses;

stock sales;

phantom stock;

other stock-based benefits; or

restricted stock units.

Stock options granted under the 2016 Plan may be incentive stock options intended to qualify under the provisions of Section 422 of the Code or non-qualified stock options that do not so qualify. However, the aggregate fair market value of stock with respect to which any employee’s incentive stock options first become exercisable during any calendar year (under all our plans and those of any subsidiary corporation) may not exceed $100,000 (as determined on the grant date), and may be further limited by other requirements in the Internal Revenue Code. If this $100,000 limitation is exceeded, the excess incentive stock options will be treated as non-qualified stock options.

Individual Limitations on Awards. In each calendar year no participant may be granted awards under the 2016 Plan (other than performance awards payable in cash) relating up to more than 1,800,000 shares. In addition, in each calendar year no participant may be granted performance awards payable in cash that exceed $1,000,000. The forgoing limitations will not apply

if it is not required in order for the compensation attributable to awards under the 2016 Plan to qualify as performance-based compensation under Section 162(m) of the Internal Revenue Code. No non-employee director participant in the 2016 Plan may be granted awards that exceed $750,000 in total value during a single calendar year.

Eligibility. Our directors, officers, employees, consultants and advisors, and those of our affiliated entities, are eligible to receive awards under the 2016 Plan, except that only non-employee directors may receive “non-employee director options,” as described below. As of December 31, 2015, 624 persons (not including consultants and advisors) were eligible for selection to receive awards under the 2016 Plan, consisting of: 609 employees other than executive officers, 7 executive officers and 8 non-employee directors.

Terms and Conditions of Non-Employee Director Options. Similar to the 2010 Plan, the 2016 Plan provides for automatic grants to non-employee directors. However, these automatic grants have been suspended since 2004. The automatic grant feature provides that immediately following each annual meeting of stockholders, each non-employee director who had served as a director since his or her election or appointment and who had been re-elected as a director at such annual meeting will automatically receive an option to purchase up to 10,000 shares of common stock. In addition, each non-employee director who was appointed or elected other than at an annual meeting of stockholders (whether by replacing a director who retired, resigned or otherwise terminated his or her service as a director prior to the expiration of his or her term or otherwise) will automatically receive an option to purchase shares of our common stock as of the date of such appointment or election, consisting of a number of shares of common stock determined by multiplying 10,000 by a fraction, the numerator of which was the number of days from the date of grant to the date of the next scheduled annual meeting of stockholders and the denominator of which was 365 (exclusive of fractional shares).

Apart from these automatic non-employee director options, which are currently suspended, non-employee directors are eligible to receive other grants of awards under the 2010 Plan, including non-qualified stock options other than the automatic non-employee director options, at the discretion of the administrator. To the extent not inconsistent with the provisions of the 2010 Plan governing non-employee director options, the terms of general stock option awards under the 2010 Plan apply to non-employee director options. Under the 2016 Plan, all grants of stock options to non-employee directors fully vest and become exercisable one year following the grant date if the non-employee director has remained a director for the entire period from the date of grant to the vesting date. If the individual was a director from the period of grant until the next annual meeting of stockholders (either because the director is not re-elected or because the director chooses not to run for another term), the stock options that were granted to the director at the annual meeting in the prior year shall continue to vest following the date that the individual ceases to be a director and shall become exercisable one year following the grant date.

Terms and Conditions of Other Awards. The administrator will select the recipients of awards granted under the 2016 Plan from the pool of eligible persons and will set the terms of the awards.

Award Pricing. The administrator will determine the exercise or purchase price of awards granted under the 2016 Plan; which, with respect to options and stock appreciation rights, will be no less than the fair market value of the shares underlying the award as of the grant date. In addition, the exercise price for an incentive stock option must comply with the provisions of Section 422 of the Code. Section 422 currently provides that the exercise price must not be less than the fair market value of the common stock on the date of grant and not less than 110% of the fair market value as of the date of grant in the case of a grant to a person owning more than 10% of the total combined voting power of all classes of the issuer’s stock or the stock of any parent or any subsidiary corporations. On March 23, 2016, the closing price of our common stock on the Nasdaq Global Market was $17.08 per share.

Award Vesting and Term. The administrator will determine the date or dates on which awards granted under the 2016 Plan vest and become exercisable. Stock options and stock appreciation rights shall not vest or become exercisable until at least one year following the date the stock option or stock appreciation right is granted; provided, however, that stock options and stock appreciation rights that result in the issuance of an aggregate of up to 5% of the shares reserved for issuance under the 2016 Plan may be granted without regard to such minimum vesting. In addition, the administrator may provide for accelerated vesting upon a change in control or the recipient’s death or disability. The term of each stock option or stock appreciation right granted will expire no later than ten (10) years after the date the stock option or stock appreciation right is granted and may be subject to earlier termination as described below. In addition, the term for an incentive stock option must comply with the provisions of Section 422 of the Code. Section 422 currently provides that the incentive stock option may not be exercisable after the expiration of 10 years from the date of grant, or five years in the case of an incentive stock option granted to a person owning more than 10% of the total combined voting power of all classes of stock of the issuer, or of its parent or any subsidiary corporations.

Awards granted under the 2016 Plan may be exercised at any time after they vest and before the expiration date determined by the administrator, provided that an award is generally exercisable following an award holder’s termination of

employment only to the extent that the award had become exercisable on or before the date of termination (other than stock options granted to non-employee directors) and to the extent that the award is not forfeited under the terms of the 2016 Plan. Furthermore, in the absence of a specific agreement to the contrary, stock options will generally expire and become unexercisable immediately upon termination of the recipient’s employment with us for just cause (as defined in the 2016 Plan); 90 days after termination of the recipient’s employment with us for any reason other than just cause, death or permanent disability; or one year after termination of the recipient’s employment with us due to death or permanent disability, in each case unless the term of the options provides for an earlier expiration. If the employment of a recipient of restricted stock is terminated for any reason, any such restricted stock that remains subject to restrictions on the date of such termination will be repurchased by the Company at the purchase price, if any, paid by the recipient, or returned to the Company without consideration, provided, however, that the administrator may in its discretion determine otherwise.

Other Award Provisions. The administrator will determine any applicable performance criteria, restrictions or conditions of any award. The administrator may establish performance criteria and level of achievement versus such criteria that will determine the number of shares to be granted, retained, vested, issued or issuable under or in settlement of or the amount payable pursuant to an award, which criteria may be based on “qualifying performance criteria” (as described below) or other standards of financial performance and/or personal performance evaluations. In addition, the administrator may specify that an award or a portion of an award is intended to satisfy the requirements for “performance-based compensation” under Section 162(m) of the Code, provided that the performance criteria for such award or portion of an award that is intended by the administrator to satisfy the requirements for “performance-based compensation” under Section 162(m) of the Code will be a measure based on one or more qualifying performance criteria selected by the administrator and specified at the time the award is granted. The administrator will certify the extent to which any qualifying performance criteria has been satisfied, and the amount payable as a result thereof, prior to payment, settlement or vesting of any award that is intended to satisfy the requirements for “performance-based compensation” under Section 162(m) of the Code. Notwithstanding satisfaction of any performance goals, the number of shares issued under or the amount paid under an award may be reduced, but not increased, by the administrator on the basis of such further considerations as the administrator in its sole discretion may determine.

For purposes of the 2016 Plan, the term “qualifying performance criteria” means any one or more of the following performance criteria, or derivations of such performance criteria, either individually, alternatively or in any combination, applied to either the Company as a whole or to a business unit or affiliated entity, either individually, alternatively or in any combination, and measured either annually (or over such shorter period) or cumulatively over a period of years, on an absolute basis or relative to a pre-established target, to previous years’ results or to a designated comparison group, in each case as specified by the administrator: (a) cash flow, (b) earnings and earnings per share (including earnings before interest, taxes, and amortization), (c) return on equity, (d) total stockholder return, (e) return on capital, (f) return on assets or net assets, (g) aggregate product price or product sales; (h) market share or market penetration with respect to specific designated products and/or geographic areas; (i) revenues, income or net income, (j) operating income or net operating income, (k) operating margin, (l) return on operating revenue and (m) research and development milestones. The administrator shall, within the time prescribed by Section 162(m), define in an objective fashion the manner of calculating the qualifying performance criteria to be used for a performance period for a particular eligible person.

Award Payments. A holder of an award may pay cash or any other consideration deemed acceptable by the administrator to pay the exercise price for the award, if any. The administrator may, in its discretion, allow an award holder to pay the exercise price for an award by delivering our common stock, except in limited circumstances.

Non-Assignability of Awards. Awards are generally not transferable by the recipient during the life of the recipient. Awards are generally exercisable during the life of a recipient only by the recipient.

Award Documentation. Each award must be evidenced by an award document setting forth such terms and conditions applicable to the award as the administrator may in its discretion determine.

Rights With Respect to Stock Ownership. No recipient of an award under the 2016 Plan or other person will have any right, title or interest in or to any shares of common stock subject to any award or any rights as a stockholder unless the award is duly exercised pursuant to the terms of the 2016 Plan and/or the shares of common stock subject to the award are issued to the recipient.

Provisions Regarding Changes in Control. As of the effective time and date of any change in control (as defined in the 2016 Plan), the 2016 Plan and any of the then outstanding awards (whether or not vested) will automatically terminate unless:

provision is made in writing in connection with such change in control transaction for the continuance of the 2016 Plan and for the assumption of such awards, or for the substitution for such awards of new awards covering the securities of a successor entity or an affiliate thereof with appropriate adjustments as to the number and kind of securities and exercise prices or measurement criteria, in which event the 2016 Plan and such outstanding awards will

continue or be replaced, as the case may be, in the manner and under the terms so provided; or

our Board of Directors otherwise provides in writing for such adjustments as it deems appropriate in the terms and conditions of the then outstanding awards (whether or not vested), including without limitation accelerating the vesting of outstanding awards and/or providing for the cancellation of awards and their automatic conversion into the right to receive the securities, cash or other consideration that a holder of the shares underlying such awards would have been entitled to receive upon consummation of such change in control had such shares been issued and outstanding immediately prior to the effective date and time of the change in control (net of the appropriate option exercise prices).

If, pursuant to these provisions, the 2016 Plan and the awards terminate by reason of the occurrence of a change in control without provision for any of the actions described in the paragraph above, then any recipient holding outstanding awards will have the right, at such time immediately prior to the consummation of the change in control as our Board of Directors will designate, to exercise or receive the full benefit of the recipient’s awards to the full extent not theretofore exercised, including any installments that have not yet become vested. All non-employee director options granted under the 2016 Plan shall automatically vest and become exercisable immediately prior to a change in control if the optionee is a director of the Company at that time.

New plan benefits

The issuance of any awards under the 2016 Plan will be at the discretion of the Compensation Committee. Therefore, it is not possible to determine the amount or form of any award that will be granted to any individual in the future. The table below sets forth the awards that were provided under the 2010 Plan during the 2015 fiscal year to our named executive officers and others. More information on the awards made during the 2015 fiscal year to the named executive officers appears in the “Grants of Plan-Based Awards in Fiscal Year 2015” table on page 39. |

| | | | | | | | | | |

| Name and Position | | Number of Stock Awards | | Number of Option Awards | | Dollar Value |

| Douglas C. Bryant | | 35,377 |

| | 93,847 |

| | $ | 1,542,483 |

|

| President and CEO | | | | | | |

| Randall J. Steward | | 5,339 |

| | 39,103 |

| | $ | 499,984 |

|

| Chief Financial Officer | | | | | | |

| Robert J. Bujarski | | 9,249 |

| | 35,192 |

| | $ | 517,436 |

|

| SVP, Business Development and General Counsel | | | | | | |

| Werner Kroll, Ph.D. | | 4,805 |

| | 35,192 |

| | $ | 449,976 |

|

| SVP, Research and Development | | | | | | |

| John D. Tamerius, Ph.D. | | 5,485 |

| | 32,846 |

| | $ | 440,657 |

|

| SVP, Strategic and External Affairs | | | | | | |

| All executive officers as a group | | 79,978 |

| | 286,198 |

| | $ | 4,250,504 |

|

| All non-management directors as a group | | 23,480 |

| | 47,946 |

| | $ | 976,271 |

|

| Employees other than executives as a group | | 84,374 |

| | 271,016 |

| | $ | 4,861,698 |

|

Tax Information

The following summary of certain federal income tax consequences of the receipt and exercise of awards we grant is based on the laws and regulations in effect as of the date of this Proxy Statement and does not purport to be a complete statement of the law in this area. Furthermore, the discussion below does not address the tax consequences of the receipt and exercise of awards under foreign, state and local tax laws, and such tax laws may not correspond to the federal income tax treatment described herein. The exact federal income tax treatment of transactions under the 2016 Plan will vary depending upon the specific facts and circumstances involved.

Incentive Stock Options. Except as discussed below, under federal income tax law, a recipient of an incentive stock option generally will not owe tax on the grant or the exercise of the option if the recipient satisfied certain employment and holding period requirements. To satisfy the employment requirement, a participant must exercise the option not later than three months after the recipient ceases to be our employee (or an employee of any parent or subsidiary corporation) (or within one year, if termination was due to a permanent and total disability), unless the recipient has died. To satisfy the holding period requirement, a participant must hold the stock acquired upon the exercise of the incentive stock option more than two years

from the date of grant of the stock option and more than one year after the transfer of the shares to the recipient. If these requirements are met, the recipient will, on the sale of such stock, be taxed on any gain, measured by the difference between the option price and the net proceeds of sale, generally at long-term capital gains rates.

If the recipient of the incentive stock option sells the shares acquired upon the exercise of the option at any time within one year after the date we issue the shares to the recipient or within two years after the date we grant the incentive stock option to the recipient, then:

if the recipient’s sales price exceeds the purchase price the recipient paid for the shares upon exercise of the incentive stock option, the recipient will recognize capital gain equal to the excess, if any, of the sales price over the fair market value of the shares on the date of exercise, and will recognize ordinary income equal to the excess, if any, of the lesser of the sales price or the fair market value of the shares on the date of exercise over the purchase price paid for the shares upon exercise of the incentive stock option; or

if the recipient’s sales price is less than the purchase price paid for the shares upon exercise of the incentive stock option, the recipient will recognize a capital loss equal to the excess of the purchase price paid for the shares upon exercise of the incentive stock option over the sales price of the shares.

The amount by which the fair market value of shares the recipient acquires upon exercise of an incentive stock option (determined as of the date of exercise) exceeds the purchase price paid for the shares upon exercise of the incentive stock option will be included as a positive adjustment in the calculation of the recipient’s alternative minimum taxable income in the year of exercise, if the recipient is subject to alternative minimum tax.

In the case of an early disposition of shares by a recipient that results in the recognition of ordinary income, we will be entitled to a deduction equal to the amount of such ordinary income. If the recipient holds the shares for the requisite period described above and therefore solely recognizes capital gain upon the sale of such shares, we are not entitled to any deduction.

Non-qualified Stock Options. Our grant of a non-qualified stock option to a recipient is generally not a taxable event for the recipient. Upon the exercise of a non-qualified stock option, the recipient will generally recognize ordinary income equal to the excess of the fair market value of the shares the recipient acquires upon exercise (determined as of the date of exercise) over the purchase price paid for the shares upon exercise of the non-qualified stock option. We generally will be entitled to deduct as a compensation expense the amount of such ordinary income. Provided the shares are held as a capital asset, the recipient’s subsequent sale of the shares generally will give rise to capital gain or loss equal to the difference between the sale price and the sum of the purchase price paid for the shares plus the ordinary income recognized with respect to the shares, and such capital gain or loss will be taxable as long term or short term capital gain or loss depending upon the recipient’s holding period after exercise.

Stock Appreciation Rights and Phantom Stock. Generally, the holder of a stock appreciation right or phantom stock award will recognize ordinary income equal to the value we pay (whether in cash, stock or a combination thereof) on the date the holder receives payment. If we place a limit on the amount that will be payable under a stock appreciation right, the holder may recognize ordinary income equal to the value of the holder’s right under the stock appreciation right at the time the value of such right equals such limit and the stock appreciation right is exercisable. We will generally be entitled to a deduction in an amount equal to the ordinary income recognized by the holder.

Stock Purchase Rights - Restricted Stock. Under the 2016 Plan, we are authorized to grant rights to purchase our restricted common stock subject to a right to repurchase such stock at the price paid by the participant if the participant’s employment or service relationship with us terminates prior to the lapse of such repurchase right. In general, there will be no tax consequences to a participant upon the grant of a right to purchase such restricted stock or upon purchase of such restricted stock. Instead, the participant will be taxed at ordinary income rates at the time our repurchase rights expire or are removed on an amount equal to the excess of the fair market value of the stock at that time over the amount the participant paid to acquire such stock. A participant who acquires restricted stock, however, may make an election under Section 83(b) of the Code with respect to such stock. If such an election is made within 30 days after the participant’s acquisition of the stock, the participant is taxed at ordinary income rates in the year in which the participant acquires the restricted stock. The ordinary income the participant must recognize is equal to the excess of the fair market value of the stock at the time of the participant’s acquisition of the stock (determined without regard to the restrictions) over the amount that the participant paid to acquire such stock. If a participant makes a timely election under Section 83(b) of the Code with respect to restricted stock, the participant generally will not be required to report any additional income with respect to such restricted stock until he or she disposes of such stock, at which time he or she will generally recognize capital gain or loss (provided the shares are held as a capital asset) equal to the difference between the sales price and the fair market value of the stock at the time or the participant’s acquisition of the stock (determined without regard to restrictions). In the event that a participant forfeits (as a result of our repurchase) restricted stock with respect to which an election under Section 83(b) of the Code has been made, the participant ordinarily will not be entitled

to recognize any loss for federal income tax purposes (except to the extent the amount realized by the participant at the time of such forfeiture is less than the participant’s purchase price for such stock). We generally will be entitled to a deduction equal to the amount of ordinary income (if any) recognized by a participant.

Other Awards. In addition to the types of awards described above, the 2016 Plan authorizes certain other awards that may include payments in cash, our common stock, or a combination of cash and common stock. The tax consequences of such awards will depend upon the specific terms of such awards. Generally, however, a participant who receives an award payable in cash will recognize ordinary income, and we will be entitled to a deduction, with respect to such award at the earliest time at which the participant has an unrestricted right to receive the amount of the cash payment. In general, the sale or grant of stock to a participant under the 2016 Plan will be a taxable event at the time of the sale or grant if such stock at that time is not subject to a substantial risk of forfeiture or is transferable within the meaning of Section 83 of the Code in the hands of the participant. For such purposes, stock is ordinarily considered to be transferable if it can be transferred to another person who takes the stock free of any substantial risk of forfeiture. In such case, the participant will recognize ordinary income, and we will be entitled to a deduction, equal to the excess of the fair market value of such stock on the date of the sale or grant over the amount, if any, that the participant paid for such stock. Stock that at the time of receipt by a participant is subject to restrictions that constitute a substantial risk of forfeiture and that is not transferable within the meaning of Internal Revenue Code Section 83 generally will be taxed under the rules applicable to restricted stock as described above.

Withholding. In the event that an optionee or other recipient of an award under the 2016 Plan is our employee, we ordinarily will be required to withhold applicable federal income taxes with respect to any ordinary income recognized by such optionee or other award recipient in connection with stock options or other awards under the 2016 Plan.

Certain Additional Rules Applicable to Awards. The terms of awards granted under the 2016 Plan may provide for accelerated vesting in connection with a change in control. In that event and depending upon the individual circumstances of the recipient, certain amounts with respect to such awards may constitute “excess parachute payments” under the “golden parachute” provisions of the Code. Under these provisions, a participant will be subject to a 20% excise tax on any “excess parachute payments” and we will be denied any deduction with respect to such excise tax payment.

Participation in the 2016 Plan by Executive Officers, Directors and Other Employees; Interest of Certain Persons in Matters to be Acted Upon

Each of our current directors, executive officers and employees is eligible to receive awards under the 2016 Plan. The administrator has the discretion to determine which eligible persons will receive awards under the 2016 Plan the amount and timing of such awards are not determinable at this time.

Vote Required and Board Recommendation

The affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote on the proposal at the Annual Meeting is required to approve the 2016 Plan.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE APPROVAL OF OUR 2016 EQUITY INCENTIVE PLAN.

PROPOSAL 5

AMENDMENT AND RESTATEMENT OF

THE 1983 EMPLOYEE STOCK PURCHASE PLAN

General

On February 23, 2016, the Board of Directors authorized, subject to stockholder approval, an amendment and restatement of the 1983 Employee Stock Purchase Plan (the “1983 Plan”) to increase the number of shares of our common stock available for issuance under the 1983 Plan from 1,250,000 to 1,500,000 shares. As of March 23, 2016, 1,172,655 shares of common stock had been sold under the 1983 Plan, leaving 77,345 shares available for future issuance under the 1983 Plan. The purpose of the amendment is to allow us to continue to utilize the 1983 Plan, and accordingly to provide us with flexibility in attracting employees in the future and to encourage employee ownership of our common stock, and approval of Proposal 5 will enable us to continue to use equity compensation for these purposes.

Summary of the 1983 Employee Stock Purchase Plan

The following summary is a description of the material features of the 1983 Plan and is qualified in its entirety by reference to the full text of the 1983 Plan, as proposed to be amended and restated, a copy of which is attached as Appendix B and incorporated herein by reference.

General. The 1983 Plan, which was adopted by the Board of Directors in March 1983 and approved by the stockholders in August 1983, provides our employees with the opportunity to purchase shares of common stock through payroll deductions. A total of 1,250,000 shares of common stock currently have been reserved for issuance under the 1983 Plan. As of March 23, 2016, 1,172,655 shares of common stock had been sold under the 1983 Plan, leaving 77,345 shares available for future issuance under the 1983 Plan.

Administration. The 1983 Plan is administered by the Compensation Committee. The 1983 Plan, and the right of participants to make purchases thereunder, is intended to qualify under the provisions of Sections 421 and 423 of the Internal Revenue Code.

Eligibility and Participation. Any person who is customarily employed by us or any of our designated subsidiaries on or before the beginning of the applicable offering period for at least 20 hours per week and more than five months per calendar year is eligible to participate in the offering under the 1983 Plan, provided that such person is employed by us on the commencement date of the offering period, subject to certain limitations imposed by Section 423(b) of the Internal Revenue Code and limitations on stock ownership as defined in the 1983 Plan. As of March 23, 2016, 611 persons (not including consultants and advisors) were eligible to participate in the 1983 Plan, consisting of: 604 employees other than executive officers and 7 executive officers.

Offering Dates. The 1983 Plan is implemented by accumulating payroll deductions of participating employees during a six-month offering period, with the offering periods thereunder to commence February 15 and August 15 of each year. The Board of Directors has the power to alter the duration of the offering periods without stockholder approval, if such change is announced at least 15 days prior to the scheduled beginning of the first offering period to be affected.

Purchase Price. The purchase price per share at which shares are sold in an offering under the 1983 Plan is the lower of 85% of the fair market value of a share of common stock on the date of commencement of the six-month offering period (the “Entry Price”), or 85% of the fair market value of a share of common stock on the last day of the offering period (the “Exit Price”). On March 23, 2016, the closing price of our common stock on the Nasdaq Global Market was $17.08 per share.

Payment of Purchase Price; Payroll Deductions. The purchase price of the shares is accumulated by payroll deductions over the offering period. The deductions may not exceed 10% of a participant’s compensation. A participant may discontinue his or her participation in the 1983 Plan, and may decrease, but not increase, the rate of payroll deductions at any time during an offering period.

Purchase of Stock. By executing a subscription agreement to participate in the 1983 Plan, the employee is entitled to have shares placed under option, which are exercisable on the last day of the offering period. The maximum number of shares placed under option to a participant in an offering period is that number determined by dividing the amount accumulated in such participant’s account during such offering period at the end of the offering period by the lower of the Entry Price or the Exit Price, subject to a maximum of 5,000 shares. Unless the employee’s participation is discontinued prior to such purchase date, his or her option for the purchase of the shares will be exercised automatically at the end of the offering period at the applicable price.